The outcry is great - Cyprus expects solidarity from fellow EU member states. In the Mediterranean Sea Cyprus is populated by rough 900000 people.

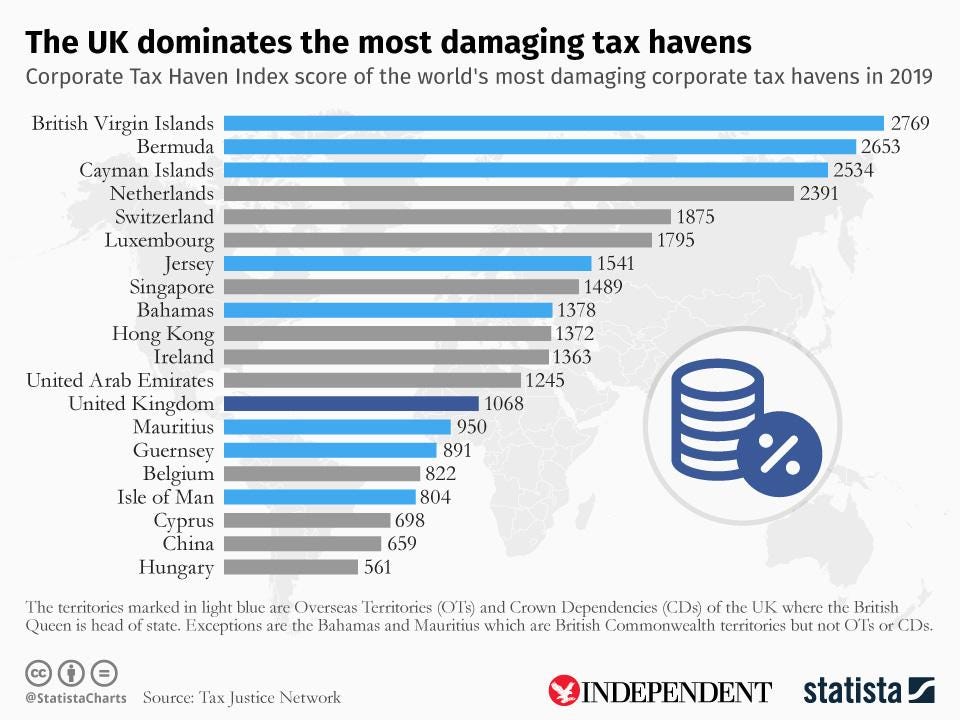

Will The Uk Become A Tax Haven After Brexit By Arnav Bajaj Datadriveninvestor

Will The Uk Become A Tax Haven After Brexit By Arnav Bajaj Datadriveninvestor

Many of them are island nations.

Cyprus tax haven. Many think of Cyprus as a Tax Haven. In fact this designation moved Cyprus away from its tax haven status. Effectively Cyprus will no longer be a tax haven for Russias rich.

Tax haven Cyprus is a developed European country and tax haven countries like tax haven Cyprus have lots of professionals. This island joined UE in 2004 has seen a growth of economic activities in the last 15 years becoming an important international financial centre. Cyprus as a Tax Haven Beginning shortly after the fall of the Berlin Wall the government of Cyprus established its country as a tax haven specifically targeting Russian oligarchs as well as.

Cyprus is well known to be a top EU tax haven offering professional offshore business and personal financial consulting advise and services. Benefits of Opening a Company in CyprusWorldwide Incorporation Services specializes in Cyprus company registration and opening bank accountsGeneral Information about Cyprus Tax HavenCyprus is a popular tourist destination island to millions of people every year. The MEPs found that seven of the EUs 28 member states Belgium Cyprus Hungary Ireland Luxembourg Malta and The Netherlands display traits of a tax haven and facilitate aggressive tax planning.

Cyprus tax haven is one of many tax havens which are located in the continent of Europe. As such it is subject to all the relevant EU directives in particular ones concerning tax matters. Seychelles was one of 30 countries blacklisted as a tax haven by the EU in 2015 but it was later moved to the gray list after making some tax reform commitments.

Offshore tax havens like Cyprus impose low or nil taxes in income. To gain compliance status Cyprus increased its corporate tax. At the same time the countrys banks are awash with foreign capital.

Cyprus is a member state of the European Union. Is Cyprus a Tax Haven. In the early 1990s the government of Cyprus.

The ending of its tax-haven status will force Cyprus to revamp its entire economic strategy and nobodys pretending that will be easy. A Tax Haven is a country in which an offshore company operating from its soil doing business only abroad Offshore is not taxed in any way. This Cyprus tax haven guide will hopefully be informative enough to give you confidence to consider the island for financial benefits.

The island of Cyprus conveniently located at the center of three continents Europe Asia and Africa is one of the most promising business hubs in the European Union because of its attractive tax regime. Russia seems to be moving in this direction without compromise so it can settle the taxation of its citizens and companies abroad but this has angered many in the Cypriot capital of Nicosia. The official languages are Greek Turkish and English the predominant one for business and state affairs.

Cyprus is not officially considered a tax haven as in 2019 they raised their corporate tax rate to 125 and the OECD gave them the same status as many other European countries. But being a tax haven has provided livelihoods for thousands of people including lawyers and trustees as well as bankers. With the British Virgin Islands identified as the most important tax haven for Chinese clients and Cyprus an important tax haven location for Russian clients.

Tax havens country Cyprus has a free industrial zone area and tax haven Cyprus encourages manufactures to come and invest in this tax haven country Cyprus. The Cyprus Tax Haven status is very different from the so called Tax Havens of other jurisdictions. Cyprus Tax Haven.

Cyprus has a comprehensive system of taxation which just happens to. The majority of clients came from mainland China Hong Kong Taiwan the Russian Federation and former Soviet republics. The tax haven of Cyprus has well recognized companies which are used for trade in tax haven Cyprus.

Since 2015 Cyprus is officially compliant with the Global Forum on Transparency Exchange of Information for Tax Purposes. Yes but not in the bad sense of this word. Is Cyprus a tax haven.

However Cyprus still offers a number of benefits for investors and companies looking to incorporate in the European Union. Tax havens are otherwise known as offshore financial centers. The island has a flourishing tourism industry and is also a shipping hub.

What is a Tax Haven by definition. The tax haven of Cyprus has many investment opportunities to help clients reduce tax liability in tax haven Cyprus.